The report reveals how consumers are “feeling” about purchasing small cars, sedans, trucks, CUVs, SUVs and other large items given the region’s current economic climate, as well as the future of the local auto industry’s health.

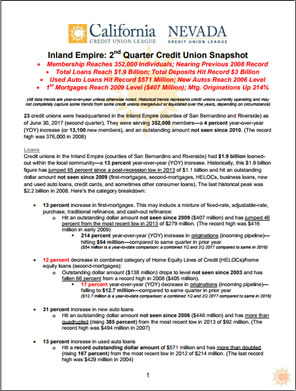

For 23 locally-headquartered credit unions in San Bernardino and Riverside counties as of second-quarter 2017:

- Loans for new light-weight vehicles hit a dollar amount not seen since 2006 ($446 million). This translates to 19,600 individual auto loans (average price of $22,755 per vehicle). This category more than quadrupled (rising 385 pee

- Loans for used light-weight vehicles hit a record dollar ($571 million). This translates to 44,040 individual auto loans (average price of $12,965 per vehicle). This category more than doubled (rising 167 percent) from the most recent low in 2012 of $214 million. (The former record peak was $429 million in 2004)

- Combined loans for new and used light-weight vehicles hit a record dollar amount ($1.01 billion). This translates to 63,640 individual auto loans (average price of $15,978 per vehicle). This category more than tripled (rising 229 percent) from the most recent low in 2012 of $309 million. (The former record peak was $898 million in 2007)

The report also gives a sense of credit unions’ rapidly increasing market share within auto lending compared to banks, finance companies, captive financing, and buy-here-pay-here entities. Credit unions nationwide experienced the highest auto lending growth in second-quarter 2017 versus the same period one year ago according to the latest “State of the Automotive Finance Market” presentation by Experian.

Below is yearly historical chart on national light-weight vehicle sales posted by the Federal Reserve, click here for more.

Some experts question whether the current cycle of automobile purchases by consumers has run its course. But it might take more than “just the end of a cycle” for annual sales at car dealerships to hit a noticeable slowdown according to Dwight Johnston, chief economist for the League.

“Spending for major purchases continues to be bolstered by the combination of rising wages and job opportunities, which is keeping consumer confidence strong,” Johnston said. “Statewide year-over-year wages in California are rising above the national average—about 4 percent compared to 2.5 percent nationally. And even though growth in jobs has slowed compared to the past five years, many employers are having trouble finding workers. The available labor pool has tightened as job openings remain at an all-time record.”

Additionally, the credit union report reveals how 352,000 credit union members across the Inland Empire are spending their money on homes, remodeling projects, higher education, life events, and other big-ticket items (see data on first-mortgages, second-mortgages, HELOCs, business loans, credit cards, and other consumer loans). As consumers make money decisions in the current environment, local credit unions are at the center of these choices.

The California Credit Union League

The California Credit Union League is based in Ontario, CA and is the state trade association for 324 credit unions headquartered across California. The League represents the interests of 11.2 million individuals who are member-owners of their locally-headquartered credit unions. Credit unions help consumers afford life and prosper!