Ontario, CA — The borrowing, spending and savings decisions that today’s Inland Empire credit union members are making provides a gauge into what’s happening across the region’s economy according to first-quarter 2018 local trends published by the California Credit Union League.

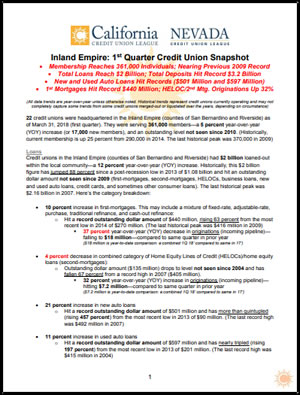

More than 17,000 consumers over the past year chose to become members of a credit union headquartered in the Inland Empire as of March 31, 2018 (first quarter)—the latest data available. Membership now exceeds 361,000 members (a level not seen since 2010).

There are 22 locally-headquartered credit unions in the Inland Empire. Local credit union members continue taking on first-mortgages to purchase or refinance homes, are turning home equity into cash for remodeling or other large purchases, and have slid into the driver’s seat of a newer car or truck thanks to an auto loan. They are also remaining true to the habit of paying for life through credit cards, but are trying to save more money and increasingly using their credit union to transact for purchases and bill-pay.

And overview of current credit union conditions:

Loans: Credit unions in the Inland Empire (counties of San Bernardino and Riverside) had $2 billion loaned-out within the local community—a 12 percent year-over-year (YOY) increase. Historically, this $2 billion figure has jumped 88 percent since a post-recession low in 2013 of $1.08 billion and hit an outstanding dollar amount not seen since 2009 (first-mortgages, second-mortgages, HELOCs, business loans, new and used auto loans, credit cards, and sometimes other consumer loans). The last historical peak was $2.16 billion in 2007.

Operations: Credit unions in the Inland Empire (counties of San Bernardino and Riverside) spent $46 million* on employees and operations (employee payroll, benefits, property, office equipment, occupancy, and vendor contracts). *Estimated quarterly figure based on year-over-year data (estimated annual figure is $184 million).

Jobs: Credit unions in the Inland Empire (counties of San Bernardino and Riverside) employed 910 individuals—a 4 percent year-over-year (YOY) increase.

The California Credit Union League is based in Ontario, CA and is the state trade association for 311 credit unions headquartered in California (as of first-quarter 2018). The League represents the interests of 11.7 million credit union members across the state who are member-owners of their credit unions. Credit unions help consumers afford life and prosper