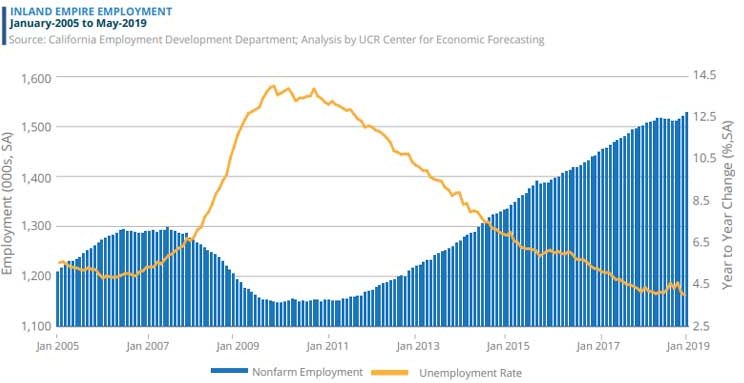

2nd Quarter Report: Inland Empire Employment Growth Slows Considerably

Wage Growth Still Trails State But Fuels Impressive Jumps In Local Taxable Sales

Riverside, CA. — Like the rest of the state, employment growth in the Inland Empire has slowed, although wage gains continue – and have fueled increases in nearly every local spending category from restaurants and hotels to business and industry, according to an analysis released today by the UC Riverside School of Business Center for Economic Forecasting and Development.

From May 2018 to May 2019, nonfarm employment in the Inland Empire increased a moderate 1.7%, about on par with the state as a whole. Last year, the region had been posting significantly higher levels of growth and regularly outpaced the state in employment gains. The slowdown can also be seen in the region’s labor force, which grew by just 2,000, or 0.1%, over this same one-year period.

Despite the slowing in employment, wages in the Inland Empire have continued to increase, although at a more modest pace than in the state. Earnings in the region grew 2.6% from 2017 to 2018 (the latest data available) while they jumped 4.1% in California as a whole.

Wage growth has triggered greater consumer and business spending both locally and across the state. Taxable sales in the Inland Empire increased 7.8% from the first quarter of 2018 to the first quarter of 2019, compared to 8.3% in California. Although spending in the region has increased across nearly all categories, business and industry sales tax receipts are leading the way with a 5.4% pace of growth. The top consumer spending category is restaurants and hotels, where taxable receipts jumped 3.7%.

“Although we’ve seen a recent deceleration in employment growth, the tight Southern California labor market has sustained wage gains – and that’s translating into more spending by businesses and consumers,” said Robert Kleinhenz Executive Director of Research at the Center for Economic Forecasting. “Looking ahead, with the U.S. expansion now in record-setting territory, the Inland Empire economy may grow more slowly in the coming months but will stay on its current growth trajectory.”

Key Findings:

- Healthcare Driven Growth: The industry driving the most job growth in the Inland Empire from May 2018 to May 2019 was Education and Healthcare, with an addition of 11,400 positions. The number two and three growth industries, Government (+5,400 positions) and Leisure and Hospitality (+4,100 positions), saw significantly less growth.

- Home Prices Continue Their Climb: A combination of space, amenities, and affordability has helped drive continued home price gains in the Inland Empire. The median price for an existing single-family home is $358,900 as of the first quarter of 2019, a 2.0% annual increase and a greater gain than occurred in Los Angeles (0.8%), San Diego County (1.8%), or Orange County, where prices actually fell (-0.1%). Still, the Inland Empire’s median home price remains 9% below its pre-recession peak of $393,400.

- Rental Market Demand Strong: Renters still enjoy a solid affordability advantage in the Inland Empire compared to surrounding regions. Average asking rent is $1,370/month as of the first quarter of 2019, compared to $2,029 in Los Angeles, $1,961 in Orange County, and $1,830 in San Diego County. The rental vacancy rate, however, is lower in the Inland Empire than in any of these other regions.

- Warehousing Stock Added As Demand Continues: The Inland Empire’s expanding Logistics sector is driving demand for warehouse and distribution space. Despite recent increases in new stock, and a resulting rise in the vacancy rate to 8.0%, asking rents increased 4.2% year-to-year in the first quarter of 2019.

The new Inland Empire Regional Intelligence Report examines employment, consumer and business spending, and residential and commercial real estate. Please view the complete analysis here.

The UC Riverside School of Business Center for Economic Forecasting and Development is the first major university forecasting center in Inland Southern California. The Center produces economic forecasting and policy research focused on the region, state, and nation. Learn more at UCREconomicForecast.org.