Inland Empire: Latest Consumer Spending Trends Activity at Local Credit Unions Reflects Current Economy

Inland Empire, CA – How 348,000 credit union members in the Inland Empire are spending their money on homes, remodeling projects, new and used automobiles, higher education, surviving life events and other big-ticket items provides a key barometer into what’s happening across the local economy.

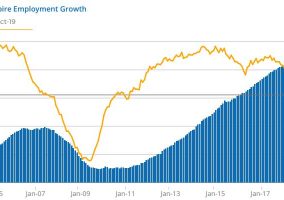

According to the 1st Quarter Credit Union Trends Report for the Inland Empire which represents 23 credit unions headquartered across the two-county region, consumers of all ages are making money decisions in the current environment that are consistent with expanding job-growth and economic trends when compared to history.

This two-page quarterly report reflects year-over-year trends in local loans and deposits and is published by the California Credit Union League. Local consumers who are members of Inland Empire-based credit unions:

- Continue taking on first-mortgages to purchase or refinance homes. First-mortgages rose 12 percent, reaching $401 million—an amount not seen since 2010 and very close to the record peak in 2009. (This may include fixed-rate, adjustable-rate, purchase, traditional refinance, and cash-out refinance mortgages)

- Are turning home equity into cash for remodeling or other large purchases. Home Equity Lines of Credit (HELOCs) and second-mortgages decreased 14 percent, dropping to $140 million—stooping to a level not seen since 2004.

- Have slid into the driver’s seat of a newer car or truck more often. Used auto loans rose 17 percent, hitting a record $552 million. New auto loans rose 34 percent, reaching $415 million—an amount not seen since 2008.

- Remain true to the habit of paying for life through their credit cards. Credit card lending rose 9 percent, reaching $97 million—an amount not seen since 2009.

- Are trying to save more money and increasingly using credit unions to transact purchases/bill-pay. Total deposits rose 9 percent, hitting a record $3 billion (including record individual amounts in checking, savings, and money market accounts)

The California Credit Union League

The California Credit Union League is based in Ontario, CA and is the state trade association for 328 credit unions headquartered across California. The League represents the interests of nearly 11 million individuals who are member-owners of their locally-headquartered credit unions. Credit unions help consumers afford life and prosper!