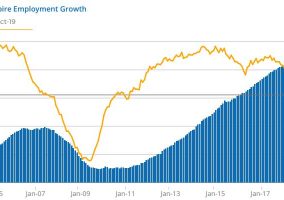

Wage Growth Increasing In The Inland Empire

IE Home Affordability Advantage Helping Labor Force Expand

Riverside, CA — Wages in the Inland Empire have been increasing, although at a slower pace than in the state as a whole, finds an analysis released today by the UCR School of Business Center for Economic Forecasting and Development. However, continued upward pressure on wages is expected this year as labor markets tighten across Southern California and the Inland Empire’s affordability advantage allows the local work force to expand more robustly than is the case in other regions.

Earnings in the Inland Empire increased 2.8% from the first three quarters of 2017 to the first three quarters of 2018 (the most recent data available); at the same time, wages in the state overall rose 4.3%. Within the region, there was little disparity with wages in Riverside County increasing 2.7% and wages in San Bernardino County jumping 2.8%.

These wage trends are occurring alongside job growth that continues to outstrip the rest of Southern California and, perhaps more importantly, in tandem with a labor force that is expanding faster than any neighboring region. From January 2018 to January 2019, the labor force in the Inland Empire grew by 2.3% compared to 0.7% in Los Angeles County, 1.7% in Orange County, 2.2% in San Diego County, and 1.5% in the state as a whole.

“The healthier growth we’re seeing in the Inland Empire’s work force is being driven in part by the region’s greater home affordability relative to surrounding areas – and this represents a significant competitive advantage into the future,” said Robert Kleinhenz, Executive Director of Research at the Center for Economic Forecasting and one of the Index authors. “At the same time, the tight regional labor market bodes well for continued wage gains to Inland Empire workers as businesses across Southern California compete to fill open positions.”

Other Key Findings:

- Spending Surge: Continued job growth and recent wage gains in the Inland Empire have fueled an impressive surge in local taxable sales as consumers, and also businesses, have boosted spending. Taxable sales in the IE increased 7.3% in 2018 over 2017, with sales in Riverside County rising 8.7% and in San Bernardino County, 6.1%. Over the same time, statewide taxable sale rose just 5.2%.

- Housing Stock Needed: There were just over 55,200 homes sold in the Inland Empire in 2018, a 6.7% decrease from 2017. This is largely an effect of the 30-year mortgage rate peaking at nearly 5% this past November, chilling sales activity. Still, while the regional affordability advantage remains intact, local home prices have risen faster than they have in neighboring areas over the past year. Additional housing stock will be critical to maintaining affordability, attracting new residents, and growing the labor force.

- Renters Under Pressure: Average asking rent in the Inland Empire increased 4.4% from the 4th quarter of 2017 to the 4th quarter of 2018, reaching $1,365 per month. Despite the jump, local renters continue to enjoy a strong cost advantage over renting in Los Angeles County ($2,004), Orange County ($1,948), or San Diego County ($1,822).

- Flying High: Passenger traffic at Ontario International Airport in 2017 was the best it’s been since 2010 – and 2018 was even better. A total of 5.12 million passengers passed through the airport last year, a 12.4% increase over 2017 and the highest number since 2008.

The new Inland Empire Regional Intelligence Report examines employment, consumer and business spending, and residential and commercial real estate. Please view the complete analysis here.

The UC Riverside School of Business Center for Economic Forecasting and Development is the first major university forecasting center in Inland Southern California. The Center is dedicated to economic forecasting and policy research focused on the region, state, and nation. Learn more at UCREconomicForecast.org.

IE Home Affordability Advantage Helping Labor Force Expand

Riverside, CA — Wages in the Inland Empire have been increasing, although at a slower pace than in the state as a whole, finds an analysis released today by the UCR School of Business Center for Economic Forecasting and Development. However, continued upward pressure on wages is expected this year as labor markets tighten across Southern California and the Inland Empire’s affordability advantage allows the local work force to expand more robustly than is the case in other regions.

Earnings in the Inland Empire increased 2.8% from the first three quarters of 2017 to the first three quarters of 2018 (the most recent data available); at the same time, wages in the state overall rose 4.3%. Within the region, there was little disparity with wages in Riverside County increasing 2.7% and wages in San Bernardino County jumping 2.8%.

These wage trends are occurring alongside job growth that continues to outstrip the rest of Southern California and, perhaps more importantly, in tandem with a labor force that is expanding faster than any neighboring region. From January 2018 to January 2019, the labor force in the Inland Empire grew by 2.3% compared to 0.7% in Los Angeles County, 1.7% in Orange County, 2.2% in San Diego County, and 1.5% in the state as a whole.

“The healthier growth we’re seeing in the Inland Empire’s work force is being driven in part by the region’s greater home affordability relative to surrounding areas – and this represents a significant competitive advantage into the future,” said Robert Kleinhenz, Executive Director of Research at the Center for Economic Forecasting and one of the Index authors. “At the same time, the tight regional labor market bodes well for continued wage gains to Inland Empire workers as businesses across Southern California compete to fill open positions.”

Other Key Findings:

- Spending Surge: Continued job growth and recent wage gains in the Inland Empire have fueled an impressive surge in local taxable sales as consumers, and also businesses, have boosted spending. Taxable sales in the IE increased 7.3% in 2018 over 2017, with sales in Riverside County rising 8.7% and in San Bernardino County, 6.1%. Over the same time, statewide taxable sale rose just 5.2%.

- Housing Stock Needed: There were just over 55,200 homes sold in the Inland Empire in 2018, a 6.7% decrease from 2017. This is largely an effect of the 30-year mortgage rate peaking at nearly 5% this past November, chilling sales activity. Still, while the regional affordability advantage remains intact, local home prices have risen faster than they have in neighboring areas over the past year. Additional housing stock will be critical to maintaining affordability, attracting new residents, and growing the labor force.

- Renters Under Pressure: Average asking rent in the Inland Empire increased 4.4% from the 4th quarter of 2017 to the 4th quarter of 2018, reaching $1,365 per month. Despite the jump, local renters continue to enjoy a strong cost advantage over renting in Los Angeles County ($2,004), Orange County ($1,948), or San Diego County ($1,822).

- Flying High: Passenger traffic at Ontario International Airport in 2017 was the best it’s been since 2010 – and 2018 was even better. A total of 5.12 million passengers passed through the airport last year, a 12.4% increase over 2017 and the highest number since 2008.

The new Inland Empire Regional Intelligence Report examines employment, consumer and business spending, and residential and commercial real estate. Please view the complete analysis here.

The UC Riverside School of Business Center for Economic Forecasting and Development is the first major university forecasting center in Inland Southern California. The Center is dedicated to economic forecasting and policy research focused on the region, state, and nation. Learn more at UCREconomicForecast.org.